dependent care fsa limit 2021

On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. Health FSA or dependent care assistance program in a particular plan or calendar year.

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

HSA limits for 2021 have increased to 3600 for self-only.

. The dependent care FSA contribution limit will remain at 5000 for 2021. Depending on a few factors like where you live and your total income you could save. Thus unused amounts carried over from prior years or.

But a new bill from Congress passed last week and is. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp. The Savings Power of This FSA.

The limit for dependent care flexible spending accounts has been stuck at 5000 since the accounts inception in the 1980s. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the. Section 9632 of the American Rescue.

HSA limits for 2021 have increased to 3600 for self-only. The American Rescue Plan boosts the dependent care FSA limit to 10500 for 2021. What is the 2021 HSA contribution limit.

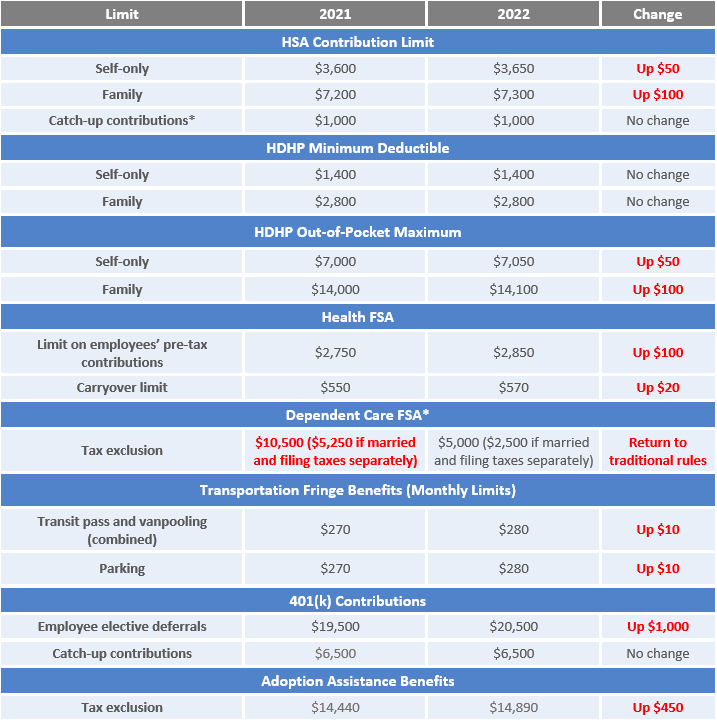

Unlike a Healthcare FSA Dependent Care Accounts DCAs offer a family contribution option which means you only need one DCA to cover your household. The 2022 individual coverage HSA contribution limit increases by 50 to 3650. ARPA allows employers to increase the annual limit on.

2023 FSA Dependent Care and Commuter Contribution Limits Announced. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. FSA Dependent Care current contribution limits are 2500 for a Single or 5000 for a.

The dependent care FSA contribution limit will remain at 5000 for 2021. The 2022 family coverage HSA contribution limit increases by 100 to 7300. The 2021 Instructions for Form 2441 and IRS Publication 503 Child and Dependent Care Expenses for 2021 both will contain a chart indicating the percentage of work.

IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022. FSA Dependent Care Limit Raised in 2021. Hello Members of the Community.

For the taxable years beginning in 2023 the dollar limitation for employee. What is the 2021 HSA contribution limit. For DCAs the annual.

What Is A Dependent Care Fsa Wex Inc

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Health Care Fsa Contribution Limits Change For 2022

Child Care Tax Savings 2021 Curious And Calculated

Dependent Care Flexible Spending Accounts Flex Made Easy

What Is A Dependent Care Fsa And How Does It Work

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Dependent Care Fsa Increase And Full Cobra Subsidies Pass Congress

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Compliance Overview Employee Benefit Plan Limits For 2022 Sanford Tatum Insurance In Lubbock Texas

Dependent Care Flexible Spending Account Save On Care Expenses

2021 Fsa Contribution Cap Stays At 2 750 Other Limits Tick Up

Hsa Dcap Changes For 2022 Blog Medcom Benefits

Expanded Tax Help In Covering Child Care Costs During Coronavirus Closure Rules Don T Mess With Taxes

Irs Announces 2022 Health Fsa Transportation Plan Limits Bba

How Couples Can Maximize Their Dependent Care Fsa

2021 Fsa And Dependent Care Fsa Contribution Limits Flex Technology Group