will capital gains tax increase in 2021 uk

The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does take place should. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does.

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Each year at the moment there is a personal capital gains tax allowance.

. Will capital gains tax increase in 2021 uk. Capital Gains Tax rates and allowances - GOVUK 5 days ago Jun. CGT raises close to 10bn a year for the Treasury and last year the chancellor commissioned the Office of Tax.

If you own a property with a. The second part of the report is due. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate.

Labour has indicated it would increase taxes on. Capital gains tax rates on most assets held for a year or less correspond to. Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and.

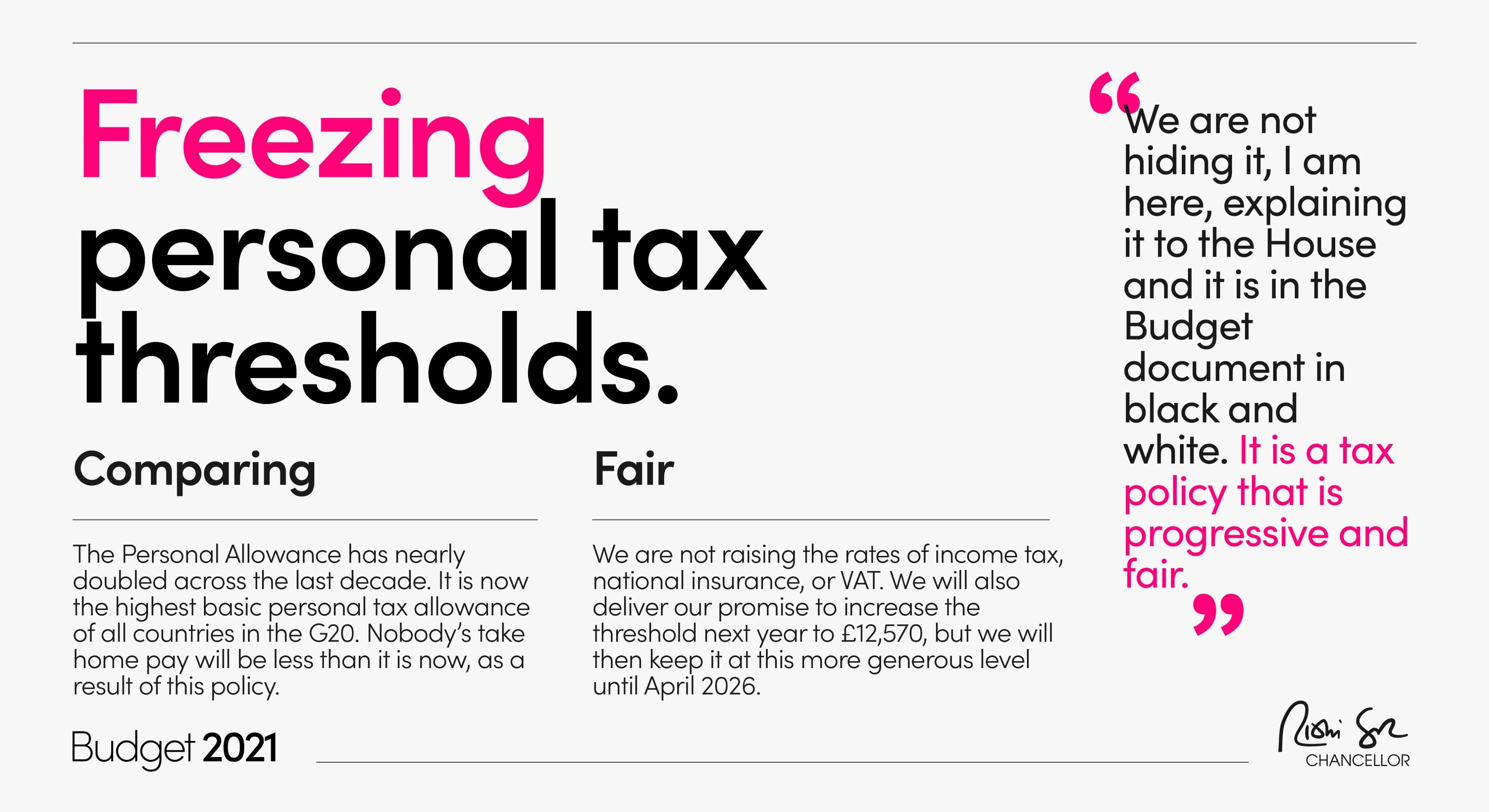

Chancellor Rishi Sunak could hike the capital gains tax rate and investors should act now by making full use of their Stocks and Shares ISA allowance. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. As a result many predicted that Chancellor Rishi Sunak would announce yet another rise in capital gains tax in.

You only have to pay capital gains tax on certain assets and do not have to pay it at all if your gains are under your tax free allowance which is 12300 or 6150 for trusts. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. 75 basic 325 higher and 381 additional.

UK landlords have had to contend with multiple tax hikes in the last few years. Entrepreneurs relief was slashed last. Capital Gains Tax Uk Made Simple In 5 Mins Free.

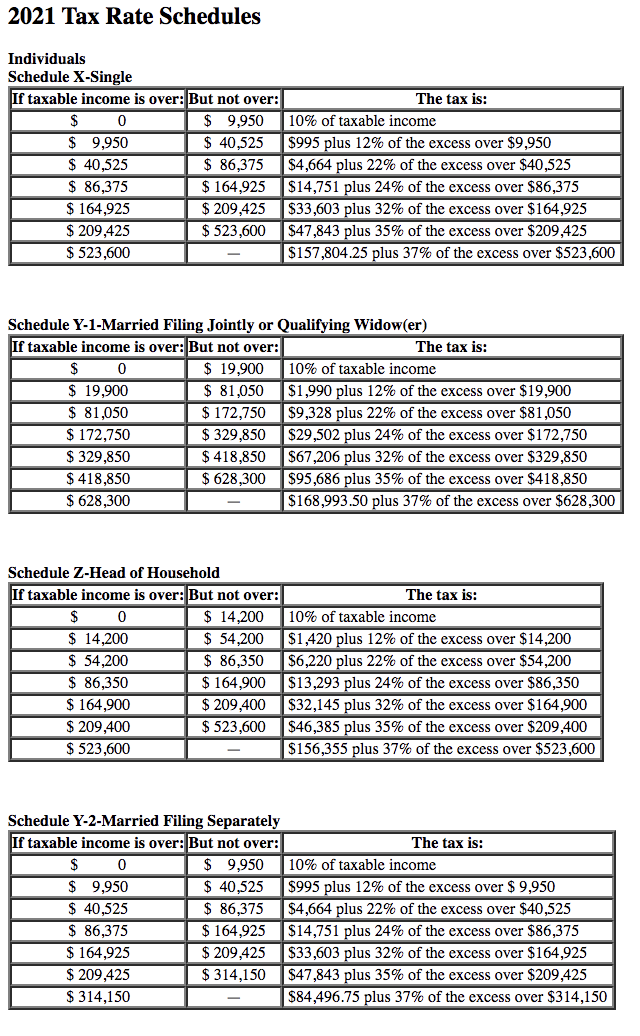

In the budget announced on Wednesday he revealed corporation tax will increase from 19 to 25 in 2023. By Charlie Bradley 0700 Thu Oct 28 2021. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is.

The maximum UK tax rate for capital gains on property is currently 28. Bringing Capital Gains Tax rates more in line with Income Tax could mean a switch to 20 per cent rates for people on the basic rate 40. 2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019.

Capital Gains Tax Hmrc with Ingredients and Nutrition Info cooking tips and meal ideas from top chefs around the world. Will capital gains tax go up in 2021. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Following Uncle Sam and What It Means for UK Entrepreneurs. One of the areas the government is looking to increase its tax collection from is capital gains. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015.

Capital gains tax increase 2021 uk Friday June 10 2022 Edit. This means youll pay 30 in Capital Gains. The capital gains tax allowance in 2022-23 is 12300 the same as it was.

Capital Gains Tax CGT has been one of the levies discussed. What is the dividend tax rate for 2021. So for the first 12300 of capital gain you could take that money completely tax-free.

For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. Tue 26 Oct 2021 1157 EDT First published on. Note that short-term capital gains taxes are even higher.

What Are Capital Gains Tax Rates In Uk Taxscouts. New Zealand companies typically adopt one of these 5 business models in the UK. Or could the tax rate be retroactively applied to the 202122 tax year.

Continued talk of a capital gains tax CGT reform in the UK has been widespread and resounding for some time. The dividend tax rates for 202122 tax year are. 2021 330 pm GMT.

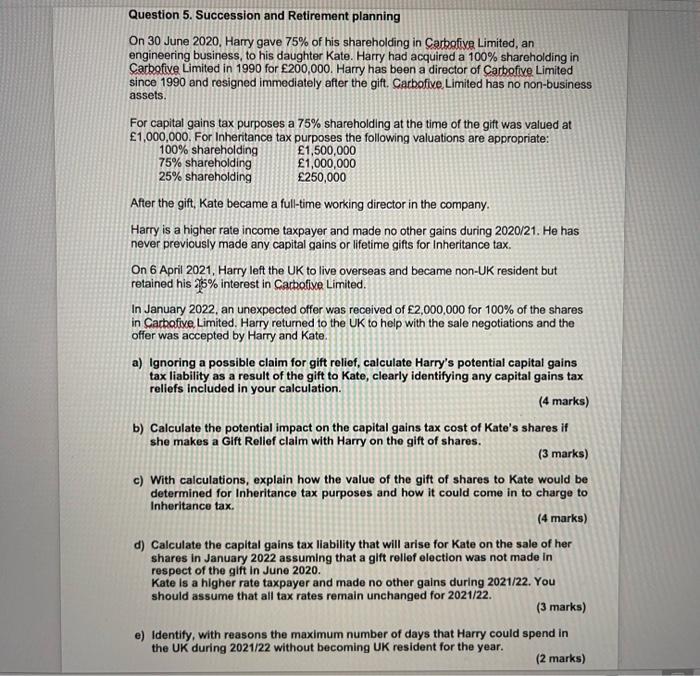

Solved Question 5 Succession And Retirement Planning On 30 Chegg Com

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Rishi Sunak Shelves Proposal To Hike Capital Gains Tax Pointing To Burden The Independent

How Will Uk Landlords Be Affected By A Capital Gains Tax Increase Business Leader News

Solved During The Current Year Ron And Anne Sold The Chegg Com

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

White House Considers Capital Gains Tax Cut Neutral Cost Recovery

Capital Gains Tax In The United States Wikipedia

Will Capital Gains Tax Rates Increase In 2021 Implications For Business Owners Bdo

Capital Gains Tax When Selling A Home Homeowners Alliance

Crypto Tax Uk Ultimate Guide 2022 Koinly

President Obama S Capital Gains Tax Proposals Bad For The Economy And The Budget Tax Foundation

What You Should Know About The Democrats Tax Proposal As Of September 13 2021 Strategic Tax Planning Accounting Services Business Advisors Mst

Savings And Investment Oecd Capital Gains Tax Retirement Accounts

Uk Budget 2021 Corporate Tax Rise Vat Cut For Hard Hit Sectors Extended Income Tax Thresholds Frozen

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)